一般K线数据,主要是记录HLOC(High,Low,Open,Close)四个值,再加上Volume交易量。在做基于K线分析时候,变动百分比也是一个经常考虑数值。这里说下增加变动百分比的属性。

其实还是很简单,如果不考虑跳空的话,就是(Close - Open)* 100.0 / Open; 考虑到跳空的话,就是当前K线结束值前取上个K线结束值,再处于上个K线结束值即可。

如果有个close的值队列的,示例代码如下

closelist = [100,99,101,103,105,109]

def getPrecentlist(inputlist):

precentlist = []

for i in range(1,len(inputlist)):

precent = (inputlist[i] - inputlist[i-1])*100.0/inputlist[i-1]

precentlist.append(precent)

return precentlist

getPrecentlist(closelist)

返回就是如下百分比队列。

[-1.0,2.0202020202020203,1.9801980198019802,1.941747572815534,3.8095238095238093]

同理, 在VNPY的K线序列管理工具ArrayManager,可以加入下面代码。按照属性返回百分比序列

@property

def percent(self):

"""获取百分比序列"""

arrayold = self.closeArray[0:self.size - 1]

arraynew = self.closeArray[1:self.size]

return map(lambda (closenew, closeold): (closenew - closeold)*100.0/closeold,zip(arraynew, arrayold))

这里稍微有点玄机,就是利用了lambda把原来function简化,同时用zip生成一个当前close和前一个close的元祖,来调来计算。

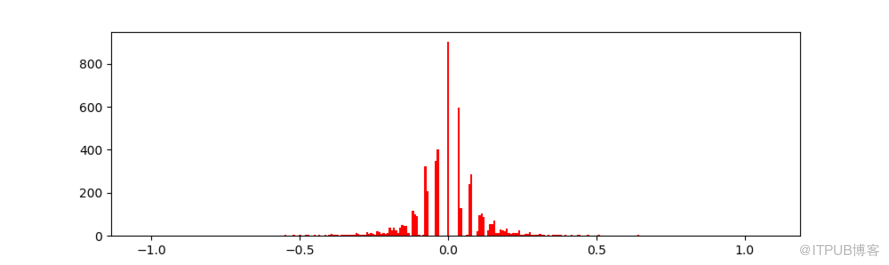

下面使用之前做的DataFrame anaylzer做的一些分析。对于豆粕m1905,从2018年09月1日到现在,10分钟K的变动百分比。

首先不出所料,precent以0为中轴的高斯分布。

比较出乎意料的是,对于最大和最小的百分之一到百分之五的K线,之后的2,4,6个K线结束时候,过半数是反转掉头的。我原来以为如果有个大的K线向上,之后回顺着向上,但是看起来,反转更能多出现。

Precent 大于 0.4312038575295748, 99时候,k线数量为 54,第二根K线结束价格上涨概率为 31.48148148148148%;

Precent 小于于 -0.4345589035350628, 1时候,k线数量为 54, 第二根K线结束价格下跌概率为 38.888888888888886%

Precent 大于 0.4312038575295748, 99时候,第四根K线结束价格上涨概率为 33.333333333333336%

Precent 小于于 -0.4345589035350628, 1时候,第四根K线结束价格下跌概率为 48.148148148148145%

Precent 大于 0.4312038575295748, 99时候,第六根K线结束价格上涨概率为 35.18518518518518%

Precent 小于于 -0.4345589035350628, 1时候,第六根K线结束价格下跌概率为 46.2962962962963%

Precent 大于 0.31567899447202463, 98时候,k线数量为 107,第二根K线结束价格上涨概率为 38.3177570093458%;

Precent 小于于 -0.3369829012686155, 2时候,k线数量为 107, 第二根K线结束价格下跌概率为 36.44859813084112%

Precent 大于 0.31567899447202463, 98时候,第四根K线结束价格上涨概率为 37.38317757009346%

Precent 小于于 -0.3369829012686155, 2时候,第四根K线结束价格下跌概率为 41.12149532710281%

Precent 大于 0.31567899447202463, 98时候,第六根K线结束价格上涨概率为 33.64485981308411%

Precent 小于于 -0.3369829012686155, 2时候,第六根K线结束价格下跌概率为 40.18691588785047%

Precent 大于 0.27096928404930803, 97时候,k线数量为 160,第二根K线结束价格上涨概率为 39.375%;

Precent 小于于 -0.2776041810690485, 3时候,k线数量为 160, 第二根K线结束价格下跌概率为 36.25%

Precent 大于 0.27096928404930803, 97时候,第四根K线结束价格上涨概率为 40.625%

Precent 小于于 -0.2776041810690485, 3时候,第四根K线结束价格下跌概率为 41.875%

Precent 大于 0.27096928404930803, 97时候,第六根K线结束价格上涨概率为 40.0%

Precent 小于于 -0.2776041810690485, 3时候,第六根K线结束价格下跌概率为 42.5%

Precent 大于 0.23543815932988155, 96时候,k线数量为 213,第二根K线结束价格上涨概率为 37.55868544600939%;

Precent 小于于 -0.24673951357067325, 4时候,k线数量为 214, 第二根K线结束价格下跌概率为 38.78504672897196%

Precent 大于 0.23543815932988155, 96时候,第四根K线结束价格上涨概率为 40.375586854460096%

Precent 小于于 -0.24673951357067325, 4时候,第四根K线结束价格下跌概率为 43.925233644859816%

Precent 大于 0.23543815932988155, 96时候,第六根K线结束价格上涨概率为 39.436619718309856%

Precent 小于于 -0.24673951357067325, 4时候,第六根K线结束价格下跌概率为 43.925233644859816%

但是,我尝试用这个规律做继续分析收益的时候,发现虽然继续向上或者向下次数不多,但是往往是巨量的,这样如果下一个反转的单子意味着巨亏。这个就是虽然小于50%出现,但是来一次都是高风险呀。

DataFrame 分析代码如下:

# encoding: UTF-8

from pymongo import MongoClient, ASCENDING

import pandas as pd

import numpy as np

from datetime import datetime

import talib

import matplotlib.pyplot as plt

import scipy.stats as scs

class DataAnalyzer(object):

def __init__(self, exportpath="C:\Project\\", datformat=['datetime', 'high', 'low', 'open', 'close','volume']):

self.mongohost = None

self.mongoport = None

self.db = None

self.collection = None

self.df = pd.DataFrame()

self.exportpath = exportpath

self.datformat = datformat

def db2df(self, db, collection, start, end, mongohost="localhost", mongoport=27017, export2csv=False):

"""读取MongoDB数据库行情记录,输出到Dataframe中"""

self.mongohost = mongohost

self.mongoport = mongoport

self.db = db

self.collection = collection

dbClient = MongoClient(self.mongohost, self.mongoport, connectTimeoutMS=500)

db = dbClient[self.db]

cursor = db[self.collection].find({'datetime':{'$gte':start, '$lt':end}}).sort("datetime",ASCENDING)

self.df = pd.DataFrame(list(cursor))

self.df = self.df[self.datformat]

self.df = self.df.reset_index(drop=True)

path = self.exportpath + self.collection + ".csv"

if export2csv == True:

self.df.to_csv(path, index=True, header=True)

return self.df

def csv2df(self, csvpath, dataname="csv_data", export2csv=False):

"""读取csv行情数据,输入到Dataframe中"""

csv_df = pd.read_csv(csvpath)

self.df = csv_df[self.datformat]

self.df["datetime"] = pd.to_datetime(self.df['datetime'])

self.df = self.df.reset_index(drop=True)

path = self.exportpath + dataname + ".csv"

if export2csv == True:

self.df.to_csv(path, index=True, header=True)

return self.df

def df2Barmin(self, inputdf, barmins, crossmin=1, export2csv=False):

"""输入分钟k线dataframe数据,合并多多种数据,例如三分钟/5分钟等,如果开始时间是9点1分,crossmin = 0;如果是9点0分,crossmin为1"""

dfbarmin = pd.DataFrame()

highBarMin = 0

lowBarMin = 0

openBarMin = 0

volumeBarmin = 0

datetime = 0

for i in range(0, len(inputdf) - 1):

bar = inputdf.iloc[i, :].to_dict()

if openBarMin == 0:

openBarmin = bar["open"]

if highBarMin == 0:

highBarMin = bar["high"]

else:

highBarMin = max(bar["high"], highBarMin)

if lowBarMin == 0:

lowBarMin = bar["low"]

else:

lowBarMin = min(bar["low"], lowBarMin)

closeBarMin = bar["close"]

datetime = bar["datetime"]

volumeBarmin += int(bar["volume"])

# X分钟已经走完

if not (bar["datetime"].minute + crossmin) % barmins: # 可以用X整除

# 生成上一X分钟K线的时间戳

barMin = {'datetime': datetime, 'high': highBarMin, 'low': lowBarMin, 'open': openBarmin,

'close': closeBarMin, 'volume' : volumeBarmin}

dfbarmin = dfbarmin.append(barMin, ignore_index=True)

highBarMin = 0

lowBarMin = 0

openBarMin = 0

volumeBarmin = 0

if export2csv == True:

dfbarmin.to_csv(self.exportpath + "bar" + str(barmins)+ str(self.collection) + ".csv", index=True, header=True)

return dfbarmin

#--------------------------------------------------------------

def Percentage(self, inputdf, export2csv=True):

""" 计算 Percentage """

dfPercentage = inputdf

for i in range(1, len(inputdf)):

if dfPercentage.loc[ i - 1, "close"] == 0.0:

percentage = 0

else:

percentage = ((dfPercentage.loc[i, "close"] - dfPercentage.loc[i - 1, "close"]) / dfPercentage.loc[ i - 1, "close"]) * 100.0

dfPercentage.loc[i, "Perentage"] = percentage

dfPercentage = dfPercentage.fillna(0)

dfPercentage = dfPercentage.replace(np.inf, 0)

if export2csv == True:

dfPercentage.to_csv(self.exportpath + "Percentage_" + str(self.collection) + ".csv", index=True, header=True)

return dfPercentage

def resultValuate(self,inputdf, nextBar, export2csv=True):

summayKey = ["Percentage","TestValues"]

dft = pd.DataFrame(columns=summayKey)

def addResultBar(self, inputdf, export2csv = False):

dfaddResultBar = inputdf

######cci在(100 - 200),(200 -300)后的第2根,第4根,第6根的价格走势######################

dfaddResultBar["next2BarClose"] = None

dfaddResultBar["next4BarClose"] = None

dfaddResultBar["next6BarClose"] = None

dfaddResultBar["next5BarCloseMakrup"] = None

for i in range(1, len(dfaddResultBar) - 6):

dfaddResultBar.loc[i, "next2BarPercentage"] = dfaddResultBar.loc[i + 2, "close"] - dfaddResultBar.loc[i, "close"]

dfaddResultBar.loc[i, "next4BarPercentage"] = dfaddResultBar.loc[i + 4, "close"] - dfaddResultBar.loc[i, "close"]

dfaddResultBar.loc[i, "next6BarPercentage"] = dfaddResultBar.loc[i + 6, "close"] - dfaddResultBar.loc[i, "close"]

if dfaddResultBar.loc[i, "close"] > dfaddResultBar.loc[i + 2, "close"]:

dfaddResultBar.loc[i, "next2BarClose"] = -1

elif dfaddResultBar.loc[i, "close"] < dfaddResultBar.loc[i + 2, "close"]:

dfaddResultBar.loc[i, "next2BarClose"] = 1

if dfaddResultBar.loc[i, "close"] > dfaddResultBar.loc[i + 4, "close"]:

dfaddResultBar.loc[i, "next4BarClose"] = -1

elif dfaddResultBar.loc[i, "close"] < dfaddResultBar.loc[i + 4, "close"]:

dfaddResultBar.loc[i, "next4BarClose"] = 1

if dfaddResultBar.loc[i, "close"] > dfaddResultBar.loc[i + 6, "close"]:

dfaddResultBar.loc[i, "next6BarClose"] = -1

elif dfaddResultBar.loc[i, "close"] < dfaddResultBar.loc[i + 6, "close"]:

dfaddResultBar.loc[i, "next6BarClose"] = 1

dfaddResultBar = dfaddResultBar.fillna(0)

if export2csv == True:

dfaddResultBar.to_csv(self.exportpath + "addResultBar" + str(self.collection) + ".csv", index=True, header=True)

return dfaddResultBar

def PrecentAnalysis(inputdf):

dfPercentage = inputdf

#######################################分析分布########################################

plt.figure(figsize=(10,3))

plt.hist(dfPercentage['Perentage'],bins=300,histtype='bar',align='mid',orientation='vertical',color='r')

plt.show()

for Perentagekey in range(1,5):

lpHigh = np.percentile(dfPercentage['Perentage'], 100-Perentagekey)

lpLow = np.percentile(dfPercentage['Perentage'], Perentagekey)

de_anaylsisH = dfPercentage.loc[(dfPercentage["Perentage"]>= lpHigh)]

HCount = de_anaylsisH['Perentage'].count()

de_anaylsisL = dfPercentage.loc[(dfPercentage["Perentage"] <= lpLow)]

LCount = de_anaylsisL['Perentage'].count()

percebtage = de_anaylsisH[de_anaylsisH["next2BarClose"]>0]["next2BarClose"].count()*100.000/HCount

de_anaylsisHsum = de_anaylsisH["next2BarPercentage"].sum()

de_anaylsisLsum = de_anaylsisL["next2BarPercentage"].sum()

print('Precent 大于 %s, %s时候,k线数量为 %s,第二根K线结束价格上涨概率为 %s%%;' %(lpHigh,100-Perentagekey,HCount , percebtage))

print('和值 %s' %(de_anaylsisHsum))

de_anaylsisL = dfPercentage.loc[(dfPercentage["Perentage"]<= lpLow)]

percebtage = de_anaylsisL[de_anaylsisL["next2BarClose"]<0]["next2BarClose"].count()*100.000/LCount

print('Precent 小于于 %s, %s时候,k线数量为 %s, 第二根K线结束价格下跌概率为 %s%%' %(lpLow,Perentagekey,LCount, percebtage))

print('和值 %s' %(de_anaylsisLsum))

de_anaylsisHsum = de_anaylsisH["next4BarPercentage"].sum()

de_anaylsisLsum = de_anaylsisL["next4BarPercentage"].sum()

percebtage = de_anaylsisH[de_anaylsisH["next4BarClose"] > 0]["next2BarClose"].count() * 100.000 / HCount

print('Precent 大于 %s, %s时候,第四根K线结束价格上涨概率为 %s%%' % (lpHigh, 100 - Perentagekey, percebtage))

# print('和值 %s' % (de_anaylsisHsum))

percebtage = de_anaylsisL[de_anaylsisL["next4BarClose"] < 0]["next2BarClose"].count() * 100.000 / LCount

print('Precent 小于于 %s, %s时候,第四根K线结束价格下跌概率为 %s%%' % (lpLow, Perentagekey, percebtage))

print('和值 %s' % (de_anaylsisLsum))

de_anaylsisHsum = de_anaylsisH["next6BarPercentage"].sum()

de_anaylsisLsum = de_anaylsisL["next6BarPercentage"].sum()

percebtage = de_anaylsisH[de_anaylsisH["next6BarClose"] > 0]["next2BarClose"].count() * 100.000 / HCount

print('Precent 大于 %s, %s时候,第六根K线结束价格上涨概率为 %s%%' % (lpHigh, 100 - Perentagekey, percebtage))

print('和值 %s' % (de_anaylsisHsum))

percebtage = de_anaylsisL[de_anaylsisL["next6BarClose"] < 0]["next2BarClose"].count() * 100.000 /LCount

print('Precent 小于于 %s, %s时候,第六根K线结束价格下跌概率为 %s%%' % (lpLow, Perentagekey, percebtage))

print('和值 %s' % (de_anaylsisLsum))

if __name__ == '__main__':

DA = DataAnalyzer()

#数据库导入

start = datetime.strptime("20180901", '%Y%m%d')

end = datetime.today()

df = DA.db2df(db="VnTrader_1Min_Db", collection="m1905", start = start, end = end)

#csv导入

# df = DA.csv2df("rb1905.csv")

df10min = DA.df2Barmin(df,10)

dfPercentage = DA.Percentage(df10min)

dfPercentage = DA.addResultBar(dfPercentage)

PrecentAnalysis(dfPercentage)

亿速云「云服务器」,即开即用、新一代英特尔至强铂金CPU、三副本存储NVMe SSD云盘,价格低至29元/月。点击查看>>

免责声明:本站发布的内容(图片、视频和文字)以原创、转载和分享为主,文章观点不代表本网站立场,如果涉及侵权请联系站长邮箱:is@yisu.com进行举报,并提供相关证据,一经查实,将立刻删除涉嫌侵权内容。

原文链接:http://blog.itpub.net/22259926/viewspace-2641780/