哈咯!想用python设计一个简单的基于做市商的股票高频交易策略,之前的主要class都已经写好了,现在在主程序里面实现策略,但是始终想不出一个合理的代码结构来实现,有没有哪位大神敢尝试啊哈哈:

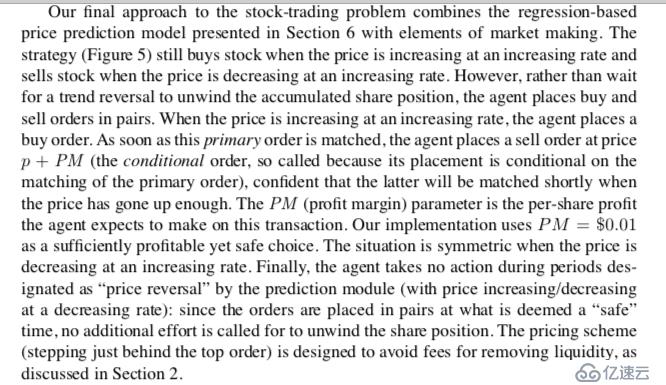

先给出模仿的论文策略图:

下面是我自己能写出的主程序部分:(如果需要我写的class可以在下面评论)

#Firstly, I load the first day's data from table BHP_data,

#then create two lists for storing the mid price and time,

#and then use for loop to read each events imformation, and store the mid price and time data into list.

#afterwards, plot the first day data and time in a figure.

import mysql.connector

import pyodbc

connection = mysql.connector.connect(user= 'root', password = '51jingtI', host = '127.0.0.1', database = 'HF2')

cursor = connection.cursor()

cursor.execute("select * from BHP_data where date='2007-07-02'")

events_data = cursor.fetchall()

#create two lists for storing the mid price and time,

money = 100

mid_price_list = []

best_ask_price_list = []

best_bid_price_list = []

time_list = []

book = OrderBook()

book_list_bid = []

book_list_ask = []

profit_list = []

for data in events_data:

S_price = float(book.best_ask_price())+0.001

S_PM_price = float(book.best_ask_price())-0.01

B_PM_price = float(book.best_bid_price())+0.01

B_price = float(book.best_bid_price())-0.001

lo = LimitOrder(data[0],data[1],data[2],data[3],data[4],data[5],data[6],data[7],data[8],data[9],data[10],data[11],data[12])

lo_b = LimitOrder(data[0],data[1],data[2],'ENTER',B_price,1,'000','','B',0,0,0,data[12])

lo_s = LimitOrder(data[0],data[1],data[2],'ENTER',S_price,1,'','000','A',0,0,0,data[12])

book.add(lo)

if book.mid_price():

mid_price_list.append(float(book.mid_price()))

if len(mid_price_list) > 10:

if ((float(mid_price_list[len(mid_price_list)-1]) - float(mid_price_list[len(mid_price_list)-2]))>0

and

(float(mid_price_list[len(mid_price_list)-1] - mid_price_list[len(mid_price_list)-2])-

float(mid_price_list[len(mid_price_list)-2] - mid_price_list[len(mid_price_list)-1]))> 0

and

len(book_list_bid) == 0):

book.add(lo_b)

book_list_bid.append(lo_b.get_id())

elif((float(mid_price_list[len(mid_price_list)-1]) - float(mid_price_list[len(mid_price_list)-2])) < 0

and

(float(mid_price_list[len(mid_price_list)-1] - mid_price_list[len(mid_price_list)-2])-

float(mid_price_list[len(mid_price_list)-2] - mid_price_list[len(mid_price_list)-1])) < 0

and

len(book_list_ask) == 0):

book.add(lo_b)

book_list_ask.append(lo_b.get_id())

if len(mid_price_list) > 50:

if not (lo_b.get_id() in book.event_dict):

lo_b_pm = LimitOrder(data[0],data[1],data[2],'ENTER',B_PM_price,1,'','test_ask_new',data[8],1,1,1,1)

book.add(lo_b_pm)

if not (lo_s.get_id() in book.event_dict):

lo_s_pm = LimitOrder(data[0],data[1],data[2],'ENTER',S_PM_price,1,'test_bid_new','',data[8],1,1,1,1)

book.add(lo_s_pm)#instrument, date, time, record_type, price, volume,bid_id, ask_id, direction, sameoffset, oppoffset, midoffset, timestamp):

plt.figure(figsize=(20,8))

plt.xlabel('volume')

plt.ylabel('Mid price')

plt.title('Mid price of BHP')

plt.plot(mid_price_list)

plt.show()

免责声明:本站发布的内容(图片、视频和文字)以原创、转载和分享为主,文章观点不代表本网站立场,如果涉及侵权请联系站长邮箱:is@yisu.com进行举报,并提供相关证据,一经查实,将立刻删除涉嫌侵权内容。